If you invest in mutual funds, proceed cautiously at year-end. At this time of year, funds may distribute any net capital gains for 2010 to their shareholders. These distributions are taxable to investors (unless the fund is held in a tax-favored retirement account), and the share price typically drops to reflect the distribution. Example 1: Caitlin Carter invests $10,000 in Mutual Fund ABC in early December 2010. She acquires 500 shares at $20 apiece. One week later, ABC makes a $2-pershare capital gain distribution, and the share price drops to $18. Caitlin owes tax on a $1,000 capital gain distribution ($2 per share x 500 shares)-even though the distribution is essentially a return of her own money. Therefore, if you

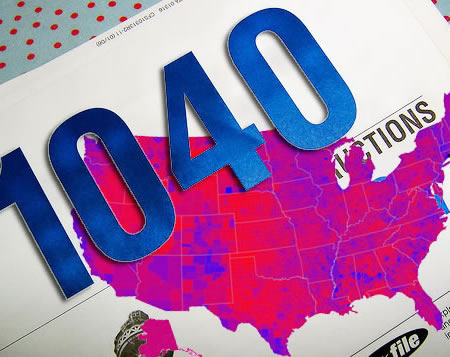

2010 Q4 | Year-End Tax Planning for Mutual Funds