Stocks performed reasonably well for much of 2011 but fell precipitously after the downgrading of the United States’ credit rating. As of this writing, the investment outlook for 2011 is quite uncertain. Despite that fact, there are things you can do with your portfolio by year-end to reduce the tax you’ll owe for 2011. Start by reviewing Schedule D of the federal income tax return you filed for 2010. See if you are carrying over any net capital losses from previous years. The next step is to tally your trading activity for 2011 so far. You can determine if you are in a net capital gain or loss position for the year to date. Example 1: Jane Collins is carrying

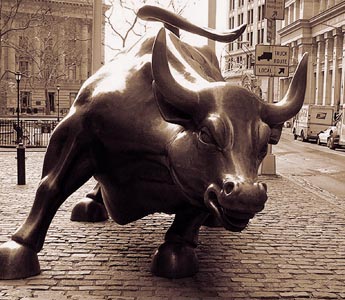

2011 Q4 Year-End Tax Planning for Investors